In today’s digital world, cryptocurrency trading has opened new doors for people to make money online. One of the simplest yet most profitable methods is crypto arbitrage trading. Many beginners are joining this trend because it offers opportunities to earn without deep technical knowledge. In this guide, you’ll learn everything about crypto arbitrage trading, how it works, its types, tools, and smart tips to start .safelyHow to Start Crypto Arbitrage Trading.crypto arbitrage trading for beginners.

What Is Crypto Arbitrage Trading?

Crypto arbitrage trading means buying a cryptocurrency from one exchange at a lower price and selling it on another exchange at a higher price. The price difference between exchanges gives you a profit.

For example, if Bitcoin is priced at $60,000 on Binance and $60,300 on Coinbase, you can buy from Binance and sell on Coinbase to make a quick profit of $300 (minus fees).

This method works because cryptocurrency prices are not the same across all exchanges due to supply, demand, and liquidity differences.crypto arbitrage trading for beginners.

Why Is Arbitrage Trading Popular Among Beginners?

Crypto arbitrage is attractive because it doesn’t require complex chart analysis or long-term market predictions. Beginners like it for several reasons:

- Low Risk: You earn from price differences, not from guessing market direction.

- Quick Profit: Trades are usually completed within minutes or even seconds.

- Automation Options: Many bots and platforms can help automate the process.

- No Advanced Skills Needed: You only need to understand exchanges and transfer basics.

How Does Crypto Arbitrage Work?

The main goal is to identify a price gap between two or more exchanges. Let’s break down the process:

- Find Price Differences: Use price tracking tools or websites like CoinMarketCap or CoinGecko.

- Buy Low: Purchase the coin from the exchange where the price is lower.

- Transfer the Coin: Send it to the exchange where the price is higher.

- Sell High: Sell the coin and collect the profit.

- Repeat the Process: Keep looking for new opportunities.

The key is speed — because crypto prices change rapidly, even small delays can affect your profit.

Types of Crypto Arbitrage Trading

There are several methods you can use depending on your experience level and tools available.

1. Simple Arbitrage

This is the easiest form. You buy a cryptocurrency from one exchange and sell it on another at a higher price. Perfect for beginners.

2. Triangular Arbitrage

This happens within a single exchange. You trade between three different cryptocurrencies to profit from price imbalances. For example: BTC → ETH → USDT → BTC.

3. Spatial Arbitrage

This type involves exchanges in different countries. Traders take advantage of regional price differences caused by currency rates or demand.

4. Statistical Arbitrage

This uses mathematical models and trading bots to find and execute multiple small arbitrage opportunities automatically.

Tools for Crypto Arbitrage Trading

To succeed in arbitrage trading, you need the right tools. Here are some popular ones:

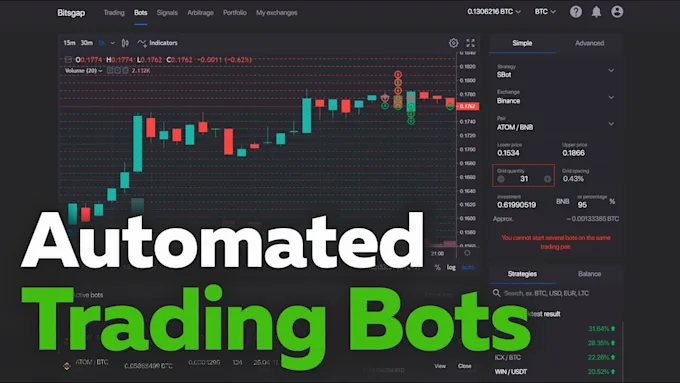

- Bitsgap: Automates trades between multiple exchanges.

- Cryptohopper: Offers arbitrage bots with custom settings.

- CoinMarketCap & CoinGecko: Track price differences in real time.

- ArbitrageScanner.io: Monitors hundreds of exchanges for profitable gaps.

Using these tools saves time and increases accuracy when spotting opportunities.

Benefits of Crypto Arbitrage Trading

- Steady Profit Potential: Even small price gaps can add up with frequent trades.

- Market Independence: You can earn whether the market goes up or down.

- Diverse Opportunities: Hundreds of coins and exchanges mean endless chances.

- Automation Support: Many bots help execute trades instantly.

Risks Involved in Arbitrage Trading

Although it sounds easy, arbitrage isn’t risk-free. Beginners should understand the possible challenges:

- Transaction Fees: Exchange fees or blockchain gas charges can eat into profits.

- Transfer Delays: Sending coins between exchanges takes time, and prices may change before you complete the trade.

- Liquidity Issues: Some exchanges may not have enough buyers or sellers.

- Regulation and KYC: Some platforms may restrict trading or require verification.

- Bot Competition: Automated systems can act faster, reducing available gaps.

Always calculate your expected profit after deducting fees and transfer times.

How to Start Crypto Arbitrage Trading (Step-by-Step)

Here’s a beginner-friendly roadmap:

- Create Accounts on at least two trusted exchanges (e.g., Binance, Coinbase, or Kraken).

- Verify Your Accounts to avoid withdrawal limits.

- Deposit Funds using stablecoins like USDT or USDC.

- Monitor Price Differences using tools or manually comparing exchanges.

- Execute Trades Quickly once you find a profitable gap.

- Track Profits and Fees regularly to know your real earnings.

- Start Small to learn before increasing your capital.crypto arbitrage trading for beginners,

Tips for Beginners

- Always check withdrawal times before transferring coins.

- Avoid trading coins with low liquidity or high transfer fees.

- Use fast blockchains like TRON (TRC-20) or Binance Smart Chain for transfers.

- Keep an eye on market trends — high volatility creates more arbitrage chances.

- Consider using demo accounts or paper trading to practice first.crypto arbitrage trading for beginners.

Conclusion

is one of the simplest ways to start earning from cryptocurrency markets. It doesn’t rely on deep technical knowledge or long-term investing strategies. With the right tools, awareness of fees, and quick execution, you can profit from small price differences across exchanges.

However, always remember that crypto markets move fast — patience, discipline, and continuous learning are key. Start small, use automation wisely, and let experience guide your way to consistent profits.